Research Briefing

| Mar 26, 2024

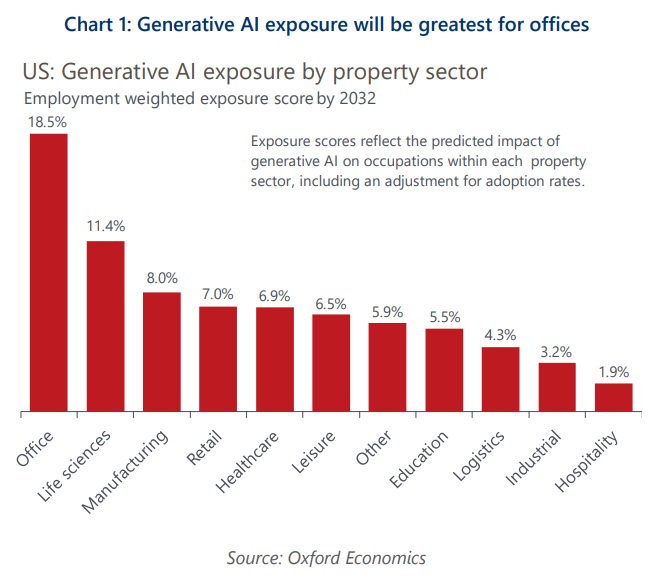

Offices globally the most exposed CRE sector to generative AI

We expect that offices will be the most exposed US property sector to the impact of generative AI by 2032, followed by life sciences and manufacturing. In contrast, the hospitality and industrial sectors look set to be the least exposed.

What you will learn:

- Generative AI will influence economies through its ability to assist or automate workplace tasks. Occupations have differing degrees of potential exposure to generative AI, based on their task composition and the expected rate of adoption.

- Occupations that are typically office-using have a greater theoretical maximum potential for generative AI to automate tasks, while these businesses are also likely to have a higher adoption rate.

- Our findings compound the bad news affecting the office sector globally, which is already suffering from the triple headwinds of home-working, working age population declines, and decarbonisation-related capex.

Tags:

Related Reports

Click here to subscribe to our real estate economics newsletter and get reports delivered directly to your mailbox

Real Estate Key Themes 2026: CRE deal recovery delayed, not derailed

Real estate is still poised for a revival in 2026. Although 2025’s deal recovery was delayed, the key fundamentals remain in place for renewed momentum.

Read more: Real Estate Key Themes 2026: CRE deal recovery delayed, not derailed

Inflation and bond yield shocks in Europe affect RE returns the most

Our modelling shows European real estate is most exposed to inflation and bond-yield shocks, with impacts varying widely across cities and sectors.

Read more: Inflation and bond yield shocks in Europe affect RE returns the most

2026 US real estate supply outlook

Explore how shifting supply trends are shaping industrial, office, retail and residential real estate in 42 US metros. Download our infographic today.

Read more: 2026 US real estate supply outlook

Real Estate Trends and Insights

Read more analysis on real estate performance and location decision-making.

Read more: Real Estate Trends and Insights[autopilot_shortcode]