Japan fiscal rigidity intensifies with fast-aging and soaring debt

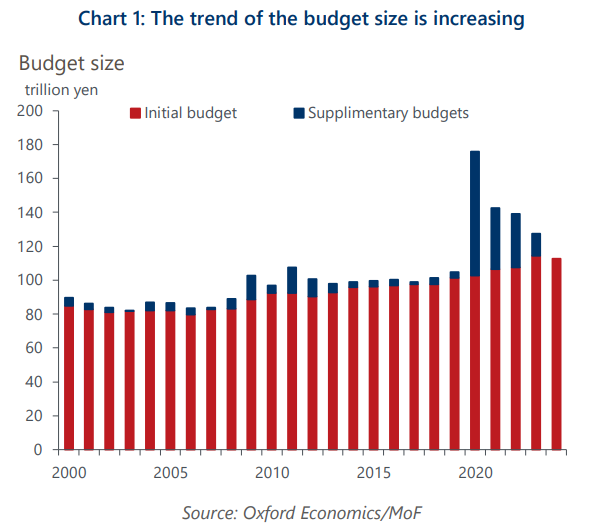

The effective size of the FY2024 initial budget continues to expand, led by structural pressures from fast-aging, rising debt servicing costs, and the increasing needs for defence spending. Fiscal rigidity has intensified as the government has no intention to hurry fiscal consolidation.

What you will learn:

- Social security expenses, which account for one-third of the budget, rose by 1 trillion yen from FY2023. Higher interest rates increased debt servicing costs by 2 trillion yen, reaching almost one-fourth of the budget. National defence spending rose by 1 trillion yen, following the government’s plan to double its size in five years to 2% of the GDP by 2027.

- Tax revenues are expected to remain the same as in FY2023, as political decision to cut income tax temporarily to support households will offset the additional revenue induced by an economic recovery.

- Although the FY2024 budget foresees a visible improvement in the primary balance, we are doubtful of its feasibility, given that it has become customary to have a sizeable supplementary budget at year-end in recent years regardless of economic conditions.

- The effective primary fiscal deficit during the pandemic was much smaller than budget figures and returned to balance in a short period because of the unspent amount and a rising share that is transferred to strategic funds which are not spent immediately

Tags:

Related Posts

Post

Japan’s fiscal policy will remain loose, which increases risks to debt sustainabilit

We've changed our fiscal outlook for Japan in our December forecast round. We now expect the new government to set a primary deficit close to that of 2024, at 2%-3% of GDP for 2025-2027, instead of restoring a balanced budget by taking advantage of strong tax revenue. We assume higher bond yields will force the government to take measures to reduce the deficit from 2028.

Find Out More

Post

Japan’s politics add uncertainty to BoJ policy outlook

The Bank of Japan (BoJ) kept its policy rate at 0.5% at its October meeting, after a 7-2 majority vote. Two board members again voted for a rate increase. We believe the BoJ will hike in December to 0.75% as incoming data confirm that the economy is performing in line with the bank's forecasts in its quarterly outlook. However, there's a material chance of a delay.

Find Out More

Post

Japan’s December rate hike appears likely, though there is a risk of delay

We've brought forward the timing of the next Bank of Japan (BoJ) 25bps rate hike to December from next year and have added another 25bps hike in mid-2026. This reflects the surprisingly hawkish shift in the BoJ's view since its September policy meeting and upward revisions to our growth and inflation projections, driven by the US economy's resilience.

Find Out More