Research Briefing

| Mar 4, 2024

Fundamentals favour London as a resi opportunity

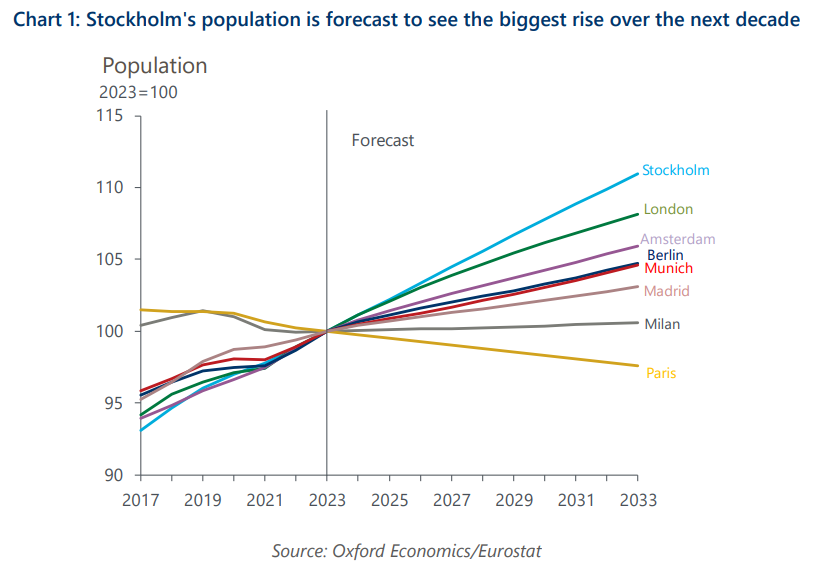

Among major European cities, we think London offers the best outlook for residential real estate based on demographic trends and supply constraints. Amsterdam and Madrid are also promising. Prospects for cities in France, Germany, and Italy are more mixed, with stretched affordability supporting rental demand, whereas demographic dynamics are relatively weak.

What you will learn:

- We forecast household numbers in Stockholm, Amsterdam and London will rise the most by the early 2030s. London also has a particularly high share of the population in the 20-34 age group, a key metric for rental demand.

- We also project Milan’s younger population will increase healthily over the next decade or so. Alongside Milan’s particularly expensive property prices relative to incomes, and supply constraints, this should support growth in rental demand.

- Berlin and Munich are both forecast to see weak growth in household formation and an outright fall in their 20-34-year-old populations. But in mitigation, the outlook for household income growth in the two German cities is comparatively strong.

Tags:

Related Reports

Click here to subscribe to our real estate economics newsletter and get reports delivered directly to your mailbox

Real Estate Key Themes 2026: CRE deal recovery delayed, not derailed

Real estate is still poised for a revival in 2026. Although 2025’s deal recovery was delayed, the key fundamentals remain in place for renewed momentum.

Read more: Real Estate Key Themes 2026: CRE deal recovery delayed, not derailed

Inflation and bond yield shocks in Europe affect RE returns the most

Our modelling shows European real estate is most exposed to inflation and bond-yield shocks, with impacts varying widely across cities and sectors.

Read more: Inflation and bond yield shocks in Europe affect RE returns the most

2026 US real estate supply outlook

Explore how shifting supply trends are shaping industrial, office, retail and residential real estate in 42 US metros. Download our infographic today.

Read more: 2026 US real estate supply outlook

Real Estate Trends and Insights

Read more analysis on real estate performance and location decision-making.

Read more: Real Estate Trends and Insights[autopilot_shortcode]