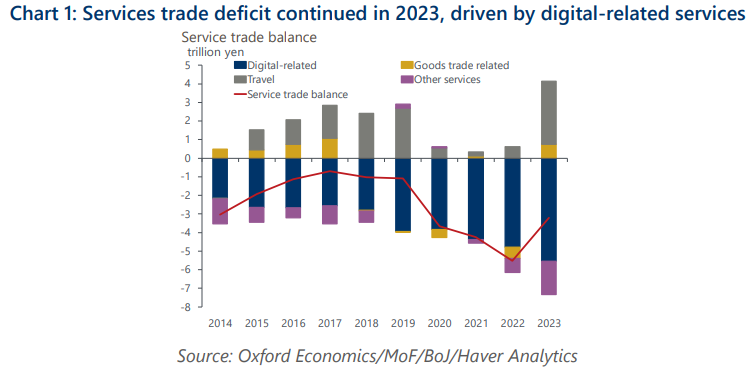

Acceleration in digitalisation will keep a service trade deficit in Japan

Japan’s services trade deficit continued in 2023, despite the sharp recovery to a travel surplus due to a rising number of inbound tourists after the pandemic. We project Japan’s services trade balance will remain in deficit over the coming years as a trend increase in the import of digital-related services will outweigh a rising travel services surplus that has been driven by inbound tourists.

What you will learn:

- In contrast to its success in manufacturing, Japan has been slow in moving up value chain in digital services. An aging population and the pandemic experience will accelerate the belated move toward digitalization, resulting in a demand drain through imports, especially from the US.

- The travel surplus will likely keep rising, driven by inbound tourists. However, it won’t be enough to offset the digital-related services deficit. The increase in the travel surplus will be constrained by a labour shortage in inbound tourism-related businesses and slow progress in raising consumption per head by providing higher value-added tourism services.

- Services trade deserves more attention in terms of its impact on Japan’s external balance and the FX market. Compared to goods trade, services trade has been more dynamic by responding more vividly to FX developments.

Tags:

Related Posts

Post

Japan’s politics add uncertainty to BoJ policy outlook

The Bank of Japan (BoJ) kept its policy rate at 0.5% at its October meeting, after a 7-2 majority vote. Two board members again voted for a rate increase. We believe the BoJ will hike in December to 0.75% as incoming data confirm that the economy is performing in line with the bank's forecasts in its quarterly outlook. However, there's a material chance of a delay.

Find Out More

Post

Japan’s December rate hike appears likely, though there is a risk of delay

We've brought forward the timing of the next Bank of Japan (BoJ) 25bps rate hike to December from next year and have added another 25bps hike in mid-2026. This reflects the surprisingly hawkish shift in the BoJ's view since its September policy meeting and upward revisions to our growth and inflation projections, driven by the US economy's resilience.

Find Out More

Post

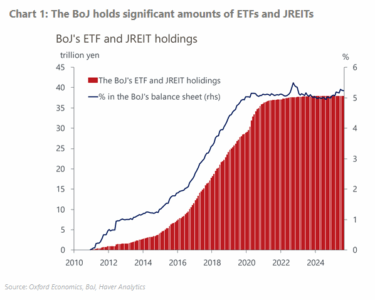

BoJ announces cautious plan to sell ETF and J-REIT holdings

At its monetary policy meeting on Friday, the Bank of Japan (BoJ) unexpectedly announced it would start to sell its ETF and Japanese real estate investment trust (J-REIT) holdings. We think the impact of this plan on financial markets will likely be limited because the BoJ is opting to play it safe in terms of the process and the scale.

Find Out More