Machine tools boosted by US fiscal policies and tech spending

The US machine tool industry has navigated through volatile markets in recent years. 2023 has proven to be a year of stabilisation. While the number of new orders has come off its high point, they remain well above pre-pandemic levels, with producer inventories now reflecting a more normal operating environment.

What you will learn:

- Policy changes and secular trends are lifting the prospects for the US machine tool industry. The former includes fiscal spending on infrastructure and incentives to underpin demand for clean energy, while the latter involves manufacturers’ moves to improve their product portfolio, with greater production efficiency.

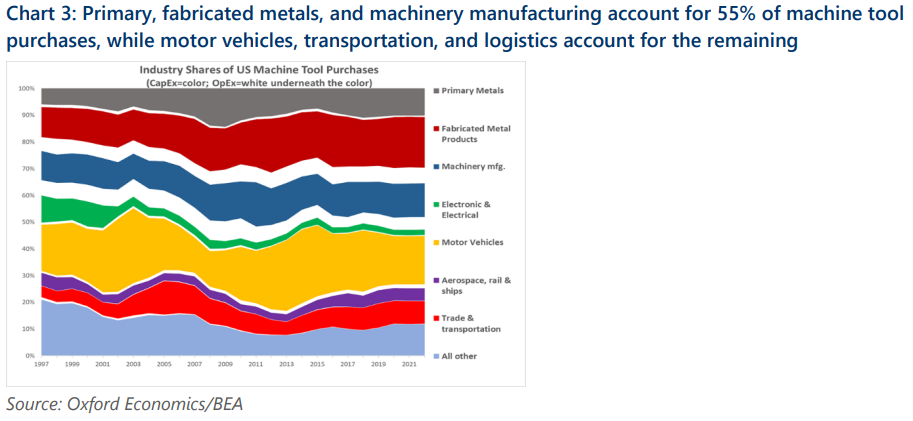

- A key factor is the strong demand emanating from the cluster of industries that purchase the bulk of machine tool products, such as motor vehicles, aerospace, electronics, electrical equipment, and batteries.

- Companies within these sectors have responded to changes in demand and domestic policy by lifting their own investment spending, including for machine tools.

- Machine tools are therefore a prime example of a sector boosted by policy changes and technology upheaval via their impacts on their largest customer markets.

Tags:

Related Posts

Post

ASEAN growth opportunities following US-China Tariffs

Using sectoral production data from Oxford’s Global Industry Service, we have been able to quantify which countries and sectors have the greatest potential for production migration. Applying this framework across Asia reveals meaningful industrial depth in Vietnam, Thailand, and Malaysia in trade-intensive segments, and a distinctive, more resource-heavy footing in Indonesia and India.

Find Out More

Post

Peak tariff impact on industry still to come

In 2026, we anticipate global industrial value-added output to grow just 1.9%, the slowest pace of growth since the global financial crisis.

Find Out More

Post

European defence spending surge: which sectors will benefit?

Our modelling suggests the main beneficiaries of the spending will be a highly concentrated subset of capital-intensive subsectors, mainly in transport and electronics.

Find Out More