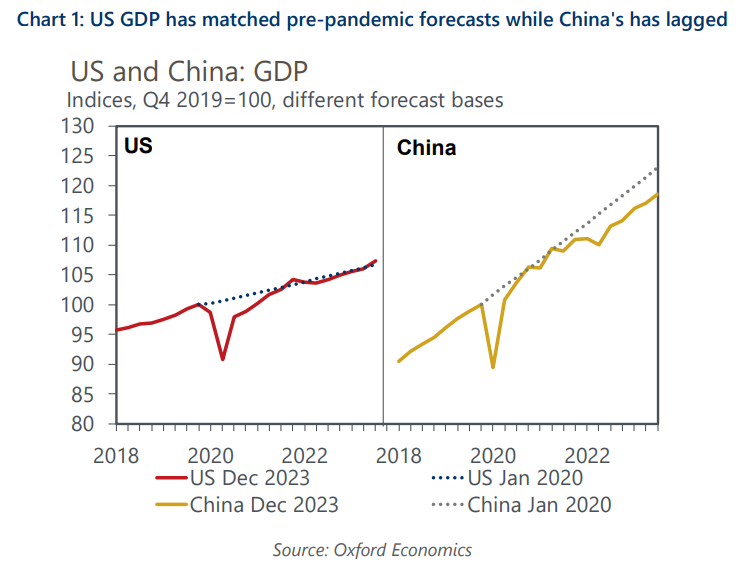

Chinese catch-up prospects recede as the US outperforms

The US has come out of the pandemic in better shape than China with GDP above pre-pandemic forecasts, whereas China has struggled in the face of structural issues like the property slump. Slower growth means China’s economy is now unlikely to match the size of the US economy until the mid-2030s and living standards will remain well below those in the US.

What you will learn:

- Our cautious baseline may overstate the prospects for Chinese catch-up with the US. Our long-term growth forecasts now show China following a similar decelerating growth path to that seen in previous decades in South Korea and Taiwan, with GDP growth falling to around 2% by 2040. This has important consequences for China’s prospects of economic catch-up.

- China’s GDP already looks larger than that of the US if purchasing power parity exchange rates are used. But PPP estimates are subject to large margins of error and have limited value in geopolitical terms.

- In addition, some estimates suggest that official Chinese data overstate its GDP by around 20%. If correct, this would mean catch-up prospects are even more distant – China’s GDP would be currently smaller than that of the US even using PPP exchange rates.

- China’s growth over the next 20 years is also subject to notable downside risks. Our baseline forecast remains dependent on strong productivity growth to offset demographic drags, and this may disappoint. The US is also likely to benefit more from a potential AI-related productivity upturn, at least initially, with decoupling potentially delaying China’s gains in this area.

Tags:

Related posts

Post

Beijing’s new industrialisation gamble – will it pay off?

Beijing's reinvigorated support for manufacturing is quite the economic gamble. With property still in the doldrums and the post-Covid services recovery having largely run its course, the rationale is that manufacturing could minimise the risk of a broader activity slowdown.

Find Out More

Post

The big questions for China macro policy this year

Ahead of this spring's Two Sessions, we expect officials to realistically stake their growth target at around 4.5% in 2024 – a more sustainable, though likely still above-potential, pace than in 2023.

Find Out More

Post

Why we lowered our China medium-term growth forecasts

The combined large shocks from years of regulatory uncertainty, the prolonged zero-Covid policy, and a housing correction have undermined China’s supply-side potential more than we previously anticipated. We have therefore cut our estimates of China's future potential GDP growth rates.

Find Out More