Can the banking system really rescue the property sector in China?

We are unconvinced that recent measures mark a turning point in China’s housing downturn, just as we were cautious of the efficacy of the “16-point” property support package a year ago.

What you will learn:

- The banking system can ‘rescue’ the property sector to the extent that it can reduce event or headline risk in China’s housing market, and therefore buttress activity in adjacent economic segments such as private investments and consumer spending, but it cannot ‘rescue’ the sector out of the necessary multiyear structural correction process that is underway.

- As housing struggles to find a floor, policy efforts are directed towards reinstalling confidence in private developers by alleviating ‘flow’ funding problems.

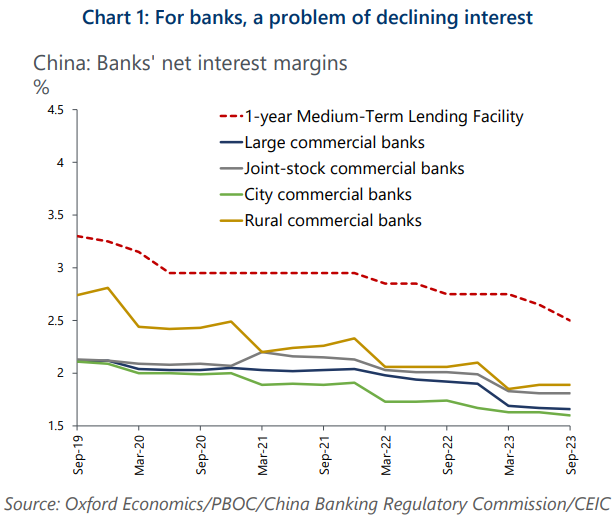

- With profitability taking a hit, large state-owned banks face the risk of further asset-quality deterioration. On the other hand, weak banks may get weaker, posing contagion risks.

- The resulting banking system is likely to be less profitable and less well-capitalised, impairing the transmission mechanism of future monetary policy. However, while the real economic impact of China’s property downturn will be sizeable and prolonged, we think ultimately, the authorities should be able to manage the downturn without it triggering a financial crisis.

Tags:

Related Posts

Post

Rising unemployment creates headaches for the RBA in Australia

Australia’s unemployment hit 4.5% in September, the highest in nearly four years. As inflation stays elevated, the RBA faces pressure to cut rates in November.

Find Out More

Post

Construction across sectors hitting record highs now and by decade’s end as economy slowly gains momentum

Australia’s construction sector is entering a defining decade. At the Australian Construction Outlook Conference 2025, Oxford Economics Australia explored the transformative trends shaping growth to 2030 - from AI-driven data centers and electrification projects to government-funded infrastructure and rising demand for social and retirement living.

Find Out More

Post

Forecasting the future workforce needs of the built environment

Oxford Economics Australia delivered the foundational labour market modelling for BuildSkills Australia’s 2024 Workforce Plan, quantifying future workforce demand across the construction, property, and water sectors.

Find Out More