The BoJ will conduct YCC policy with greater flexibility

Despite today’s (28th July) surprise tweak to YCC policy, we continue to believe that Governor Ueda is determined to avoid premature tightening and will spend another year or so to carefully assess whether the economy is on track to achieve 2% inflation within his five-year term.

What you will learn:

- Their aim is to enhance the sustainability of the current easing framework in a forward-looking manner. Highlighting “extremely high uncertainties” in the inflation outlook, the BoJ argues that strictly capping yields will hamper bond market functioning and increase market volatility when upside risks materialize.

- The median core-core CPI (excluding fresh food and energy) forecast in the BoJ’s Quarterly Outlook Report was revised up to 3.2% from 2.5% for FY2023. However, it remained short of the 2% target in FY2024 and FY2025 at 1.7% and 1.8%, respectively. The central bank’s risk assessment of the inflation forecast for FY2023 and FY2024 is now skewed to the upside.

- We are confident in our forecast that inflation will moderate over H2 2023 because import costs have been trending down since mid-2022. Core-core CPI appears to be gradually losing inflation momentum recently, based on three-month rates rather than the year-on-year measure.

Tags:

Related posts

Post

Japan’s politics add uncertainty to BoJ policy outlook

The Bank of Japan (BoJ) kept its policy rate at 0.5% at its October meeting, after a 7-2 majority vote. Two board members again voted for a rate increase. We believe the BoJ will hike in December to 0.75% as incoming data confirm that the economy is performing in line with the bank's forecasts in its quarterly outlook. However, there's a material chance of a delay.

Find Out More

Post

Japan’s December rate hike appears likely, though there is a risk of delay

We've brought forward the timing of the next Bank of Japan (BoJ) 25bps rate hike to December from next year and have added another 25bps hike in mid-2026. This reflects the surprisingly hawkish shift in the BoJ's view since its September policy meeting and upward revisions to our growth and inflation projections, driven by the US economy's resilience.

Find Out More

Post

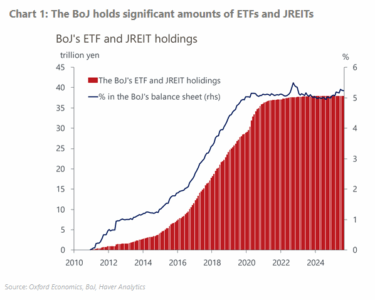

BoJ announces cautious plan to sell ETF and J-REIT holdings

At its monetary policy meeting on Friday, the Bank of Japan (BoJ) unexpectedly announced it would start to sell its ETF and Japanese real estate investment trust (J-REIT) holdings. We think the impact of this plan on financial markets will likely be limited because the BoJ is opting to play it safe in terms of the process and the scale.

Find Out More