Chartbook: what’s next for China in 2023?

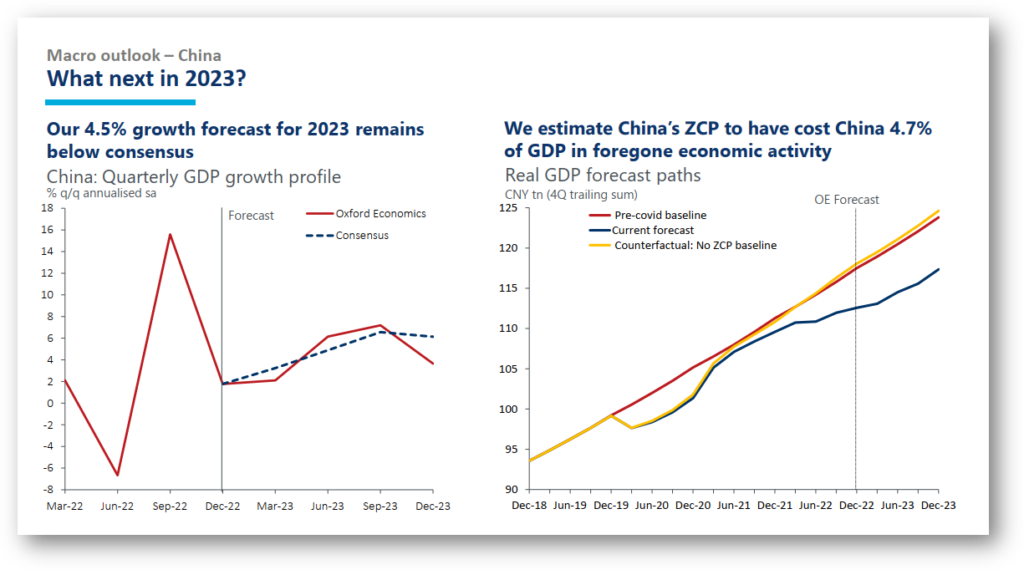

While China’s sooner-than-expected reopening has led some to pencil in a more robust rebound in 2023, we are more cautious. Our 4.5% growth forecast for 2023 remains below consensus.

What you will learn:

- The good news is that there are now tentative signs of stabilisation, as policy support doled out towards the end of 2022 showed up in the relative resilience of infrastructure investment and credit growth. The better news is that authorities will want to do more, and we see continued policy accommodation, primarily through off-budget fiscal channels in 2023.

- The bad news is that intrinsic drivers of the economy remain anaemic and in the longer term, structural challenges continue to cloud the economic outlook. Total population declined for the first time in 2022 since 1961, underscoring policymakers’ overarching productivity challenge.

- Our proprietary model estimates that China’s zero-Covid policy over the past three years has cost the economy 4.7% of its GDP in foregone activity.

Tags:

Related Resources

Post

APAC Key Themes 2026: Paybacks, policy offsets and trade

We believe APAC will remain the strongest global performer in 2026. However, the growth trajectory will likely be more uneven than in past cycles.

Find Out More

Post

Airbnb’s Economic Contribution to APAC in 2024: GDP, Jobs, and Regional Impact

Airbnb's platform connects hosts across Asia Pacific (APAC) with travellers from around the world. Oxford Economics was commissioned by Airbnb to quantify its economic footprint in 10 APAC markets in 2024.

Find Out More

Post

New Rules of Engagement: The Strategic Rise of Government Affairs in Asia

What’s behind Asia’s new era of policy assertiveness? What does it mean for international firms?

Find Out More