Japan’s consumption recovery depends on high-income households

The consumption recovery in Japan has been noticeably slower than in other advanced economies. The recent pick up in the pace of the recovery was mainly brought about by an increase in discretionary spending among high-income households, supported by accumulated savings and wealth effects.

What you will learn:

- Households in the low- and middle-income bracket have barely managed to maintain essential consumption in an environment of rising prices of necessities and stagnant wages.

- The fall in discretionary spending among the middle class is particularly significant because their real income has fallen quickly, with little support from savings and assets.

- Although our analysis suggests that there is still unfulfilled pent-up demand for discretionary spending among the rich, it will gradually lose momentum by mid-2023. We don’t expect consumption to regain its 2019 level until 2024.

Tags:

Related posts

Post

Japan’s politics add uncertainty to BoJ policy outlook

The Bank of Japan (BoJ) kept its policy rate at 0.5% at its October meeting, after a 7-2 majority vote. Two board members again voted for a rate increase. We believe the BoJ will hike in December to 0.75% as incoming data confirm that the economy is performing in line with the bank's forecasts in its quarterly outlook. However, there's a material chance of a delay.

Find Out More

Post

Japan’s December rate hike appears likely, though there is a risk of delay

We've brought forward the timing of the next Bank of Japan (BoJ) 25bps rate hike to December from next year and have added another 25bps hike in mid-2026. This reflects the surprisingly hawkish shift in the BoJ's view since its September policy meeting and upward revisions to our growth and inflation projections, driven by the US economy's resilience.

Find Out More

Post

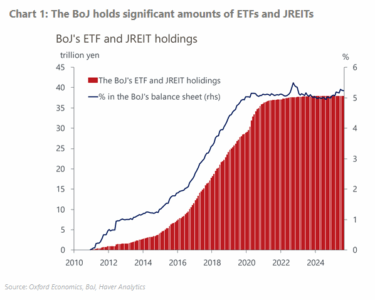

BoJ announces cautious plan to sell ETF and J-REIT holdings

At its monetary policy meeting on Friday, the Bank of Japan (BoJ) unexpectedly announced it would start to sell its ETF and Japanese real estate investment trust (J-REIT) holdings. We think the impact of this plan on financial markets will likely be limited because the BoJ is opting to play it safe in terms of the process and the scale.

Find Out More