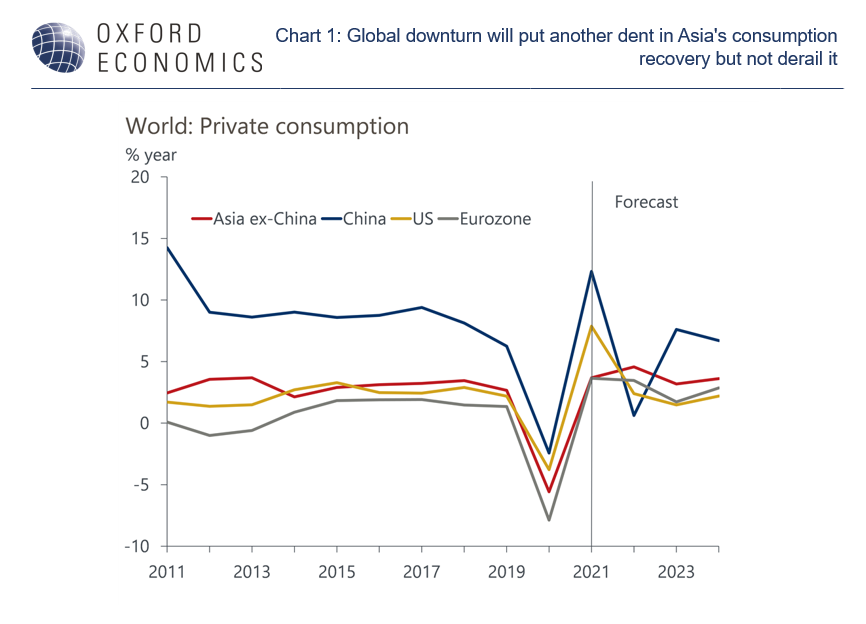

APAC’s consumption recovery will slow into 2023, but not reverse

The pace of Asia’s household spending will likely lose steam from here as tailwinds from re-openings ease, real income growth slows, and sentiment weakens amid a challenging global backdrop. Within the region, we think downside pressures are more pronounces for northeast Asian as compared to India and Southeast Asia.

Still, with most of the continent finally treating Covid as endemic, we expect private consumption growth to remain resilient in 2023 and generally outperform other regions.

What you will learn:

- An important reason for our outlook is that real incomes are expected to rise in Asia in 2022 and 2023.

- With household savings rates still above pre-pandemic levels, consumers also have the scope to save less. In general, we expect savings rates to fall below 2019 levels next year.

- Finally, the policy backdrop is expected to stay supportive. While rate hikes have picked up recently, the pace of tightening is not nearly aggressive enough to cripple spending or topple growth.

- That said, we must note that growth resilience in the short term does not improve Asia’s medium-term outlook. It only prevents it from worsening. Within the region, we think downside pressures are more pronounced for Northeast Asia vs. India and Southeast Asia.

Tags:

Related posts

Post

The rise of Southern India’s business service hubs

Over the next five years, India is set to be one of the fastest-growing major economies across Asia Pacific, lead by the performance of its IT and business services. The Southern states of Karnataka and Telangana are at the forefront of this success as they are home to two of India’s most rapidly growing cities and productive cities—Bengaluru and Hyderabad.

Find Out More

Post

Tech-enabled productivity may mean a job-lite expansion in Asia Pacific

The US is undergoing or heading towards a 'jobless expansion'. Asian economies, likewise, will probably experience slow job growth over the next few years, accompanied by mechanically rising productivity gains. In the near term, the drag on the job market is likely to come from cyclically weak demand for labour. But further down the line, it is the shrinking labour supply that will weigh more heavily on employment growth.

Find Out More

Post

China’s export transition reorders regional supply chains

China’s emerging roles as both a critical intermediate goods supplier to global supply chains and a dominant producer of high value-added goods will remain the key forces sustaining its large current account surplus, far more so than the eventual direction of US tariffs.

Find Out More