欧元区: 红海中断造成损害的迹象甚微

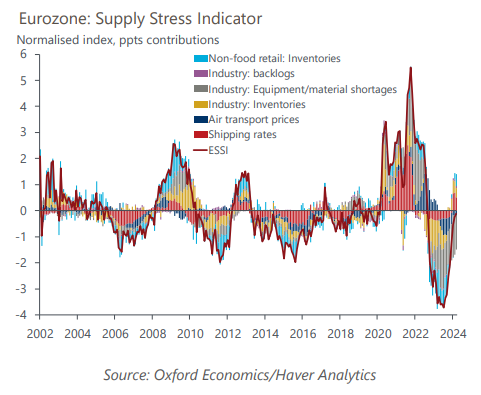

红海航运中断对欧元区经济的影响仍然有限,这与我们的基线观点一致。 我们最新的欧元区供应压力指标表明,供应压力在 2023 年出现一段时间的缓解后已恢复正常。

你将了解到什么:

- 在最初的评估中,我们假定受影响航线的运费将上涨约200%,并在此水平上稳定6个月。 令人鼓舞的是,运费率已从1月份的峰值略有回落。 此外,早期的价格和企业调查数据表明,到目前为止,负面影响有限且分散。

- 鉴于对国内价格的传导缓慢,我们预计干扰的影响将在年底达到顶峰。 但能源价格下跌和需求低迷带来的更广泛的通货紧缩压力意味着,我们预计商品通胀率将保持在低位,而这种干扰不应妨碍欧洲央行降息。

- 不过,不利风险并未消散。 到目前为止,我们还没有看到任何明显的迹象表明,投入品的缺失会导致供应中断或大面积停产,但这些情况可能会在以后出现。 同样,虽然大多数航运公司现在都避开红海,但袭击升级将对欧元区的产出和价格产生负面连锁反应。

Tags:

相关文章

文章

Eurozone: Corporate profit margins have further to fall

Profit margins in the eurozone have largely dropped back towards their long-term pre-pandemic average, after they increased faster than wages during the post-pandemic rebound. But we think margins will narrow further as wages catch up to inflation and productivity remains weak.

了解更多

文章

Eurozone: ECB rate cut decisions won’t likely be affected by the Fed

A scenario where neither the Federal Reserve nor the European Central Bank cut rates in 2024 would reduce eurozone GDP by 0.5ppts by 2025. We still think the eurozone economy would grow by 0.5% in 2024, but the projected expansion in 2025 would be 1.4%, lower than 1.8% in our baseline forecast.

了解更多

文章

Eurozone: New wage growth data suggest no need to delay rate cuts

Our sentiment data suggests that the ECB's worries about sticky inflation driven by strong wage growth are misplaced. The sentiment data-based nowcast, which allows us to track labour market developments in near-real time, suggests that pay growth continued to cool at the start of 2024 and is running below the ECB's projections.

了解更多