US Industry Service

Outlook for more than 250 detailed sectors in the NAICS classification, including industrial, technology, transportation, business services, entertainment, and composites and aggregates. Key indicators include output, prices, CapEx, OpEx and profits.

Try for free

Overview

Our unique techniques of integrated modelling enable us to translate how macroeconomic developments affect demand, supply, and investment trends across multiple sectors, in a consistent way. This provides clients with a unique tool for long-term strategic planning, risk analysis and assessment of US sector trends and opportunities.

An insightful suite of services

Our US Industry Service provides forecasts and historical data for a comprehensive understanding of the US economic structure and its evolution over time.

Rigour and accuracy

Oxford Economics has a stringent and rigorous forecasting process to ensure full consistency and integration with macroeconomic conditions.

Timely updates

Our forecasts are updated quarterly, using the latest macroeconomic and sectoral data.

Benchmarking

Analysis of the outlook for the sectors you purchase from and sell to under alternative economic scenarios allows you to benchmark corporate performance.

Extensive sectoral coverage

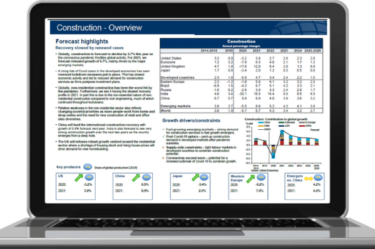

The service covers more than 250 sectors and features a data dashboard that provides key metrics and tracking charts for each individual sector. In addition, a quarterly report highlights the factors underpinning the forecasts across the major headline sectors.

A comprehensive service

Our service allows you to make informed decisions thanks to rigorous and consistent data and the tools and the support necessary to interrogate the data.

Making your job easier

Our interactive databanks and dashboards put key metrics at your fingertips, allowing you to quickly find the information and analysis you need.

Service features

Forecasts and historical data for more than 250 industries.

Our service follows the NAICS industrial classification. Updated quarterly, drawing on our baseline macroeconomic forecasts for the US and global economies, and our global industry forecasts.

Analysis of key drivers and our forecast outlook.

Coverage

Our service covers key economic indicators for more than 250 industries across multiple sectors:

- Mining

- Machinery manufacturing

- Electronics and electrical

- Transportation equipment

- Metals, construction materials, furniture

- Non-durables manufacturing

- Utilities

- Construction

- Distribution and accommodation

- Transportation by mode Information and communications

- Financial and real estate

- Business and professional services

- Public, education, and health care

- Recreation and entertainment

Indicators include gross output, value-added, CapEx, OpEx, prices and profits. Fill out the form to request more information about the service and its coverage.

United States Industry Service

The US Industry Service features historical data and forecasts for 261 individual industries, which together comprise the entire US economy.

“Oxford Economics’ data and forecasts form the backbone of our demand models. The global consistency and granular detail available in their expansive dataset allows us to focus on the variables most relevant to our business.”

Resources and events

Research Briefing

US and Canada housing affordability edged down in Q3

Research Briefing

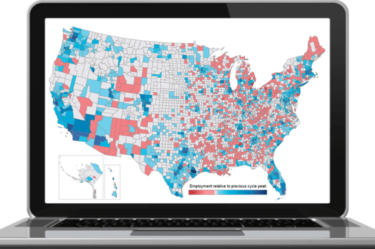

United States recoveries in 2022 are inversely proportionate to 2020 declines

Research Briefing

US Recovery Tracker drops on Omicron and seasonal drags

Research Briefing

United States Recovery Tracker surpasses its pre-Covid level

Event

Olivier Blanchard at our annual New York conference

Webinar

Will overtourism problems return for cities?

Webinar

Global construction sector continuing to rebound in 2022

Webinar

Air travel recovery to resume in 2022 post-Omicron

United States 2022 Themes: A ‘MESSI’ year ahead

Featured

Request a Free Trial

Complete the form and we will contact you to set up your free trial. Please note that trials are only available for qualified users.

We are committed to protecting your right to privacy and ensuring the privacy and security of your personal information. We will not share your personal information with other individuals or organisations without your permission.

Download the brochure for United States Industry Service

Download

Related services

Service

Global Industry Service

Gain insights into the impact of economic developments on industrial sectors.

Find Out More

Service

US Construction Service

A comprehensive five-year outlook for construction activity in the United States.

Find Out More

Service

US States and Metro Service

Forecasts, scenarios and analysis for US states, metropolitan statistical areas and counties.

Find Out More

Service

US Forecasting Service

Access to short- and long-term analysis, scenarios and forecasts for the US economy.

Find Out More

Service

Global Sustainability Model

Accurately measure your organisation's global footprint through economic, environmental and social lenses, identify risks and develop strategies to become more sustainable.

Find Out MoreTrusted By