Research Briefing

| Apr 24, 2024

Demographics are set to propel niche property types in the UK

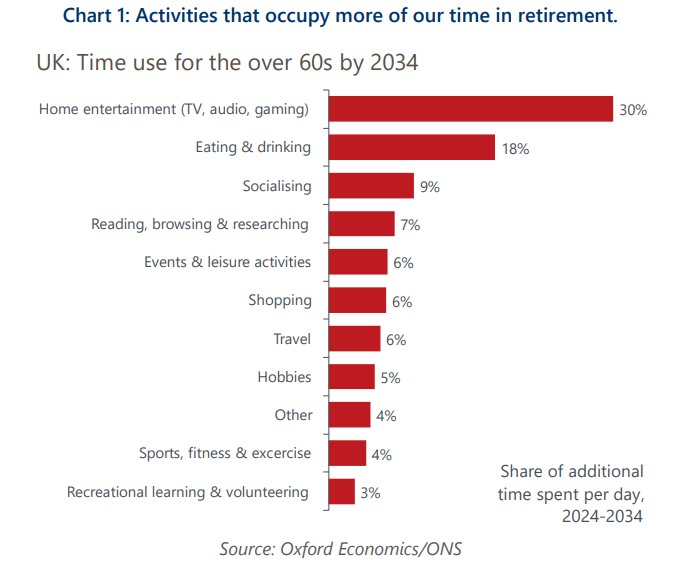

How we spend our time varies through our lives. As the UK population ages, time-use data suggest that the property sectors with structural tailwinds will be those that provide space for activities related to home entertainment, eating and drinking, socialising, events, leisure, hobbies, and sports/exercise.

What you will learn:

- Growth in the digital economy threatens the demand for physical space across various sectors. Retail and offices face well-known challenges from e-commerce and home working, while generative artificial intelligence has the potential to further disrupt demand for offices and life sciences.

- The interplay between the two megatrends of AI and demographics increases the importance of understanding the daily activities that people spend their time on, and require physical space to facilitate, whilst accounting for the effects of population ageing.

- Our approach identifies the daily activities that will become more important over the next decade, and could help achieve benchmark outperformance over the long run.

Tags:

Related Reports

Click here to subscribe to our real estate economics newsletter and get reports delivered directly to your mailbox

Demographics are set to propel niche property types in the UK

As the UK population ages, time-use data suggest that the property sectors with structural tailwinds will be those that provide space for activities related to home entertainment, eating and drinking, socialising, events, leisure, hobbies, and sports/exercise.

Read more: Demographics are set to propel niche property types in the UK

Amid disruption, what can US office learn from retail?

We examined the disruption of generative AI at the US county level. We identified several metros – Atlanta, Denver, New York, San Francisco, and Washington DC – that had at least one county with the highest percent of displaced workers from AI.

Read more: Amid disruption, what can US office learn from retail?

Global Private equity real estate fund maturities spur asset sales

We expect the significant increases in fund maturities, spurred by capital raised over the past decade, to exert upward pressure on the rate of asset disposals as the funds approach the end of their lifecycles.

Read more: Global Private equity real estate fund maturities spur asset sales

Real Estate Trends and Insights

Read more analysis on real estate performance and location decision-making.

Read more: Real Estate Trends and Insights