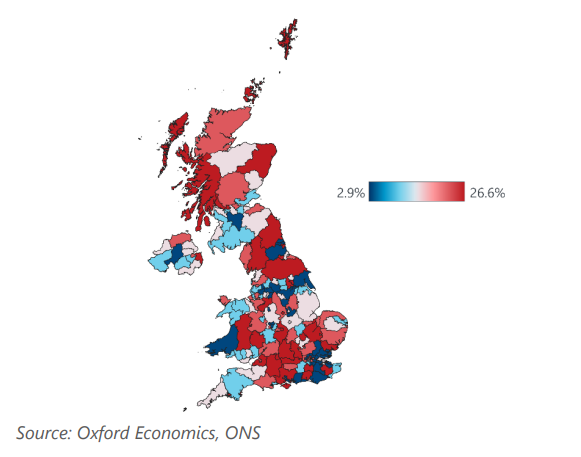

UK: Supply constraints are probably less prominent in the south

The extent to which UK employers can respond to likely 2024 interest rate cuts with increased output, rather than rises in prices and wages, will partly reflect the extent of spare capacity. This will inevitably vary by region. Evidence on this is imperfect, but in terms of capital assets (including intangibles) and labour availability, southern regions appear to be in a stronger position than those in the UK’s traditional industrial heartland.

What you will learn:

- Using ONS data on investment flows, we estimate that some regions probably have more spare capital assets than others. The East of England, the South East, and South West are likely to be in a stronger position than Yorkshire and the Humber, Wales, or the North East: three parts of the UK’s industrial heartlands.

- Recent (Q4 2023) survey information from the ICAEW Business Confidence Monitor offers a similar story, with companies in the East of England and South West most likely to have some spare capacity, though less so for the South East. Using this measure, the West Midlands is particularly short of capacity. So too is London, but clearly as a largely service-based economy, the meaning of the term is likely to be slightly different in the capital

- The other main dimension to consider is spare capacity in the labour market. The unemployment rate in the East Midlands was particularly high in Q4 2023, and closer to pre-Covid-19 norms than in other regions—possibly implying spare capacity there. But it may also imply weakness in demand or a skills mismatch.

- Unemployment was also pretty close to historical norms in the South East, reflecting the limited scope for it to fall. Again, it is older industrial regions (Northern Ireland, Yorkshire and the Humber, the North East) where unemployment looks particularly low relative to historical trends, implying they may have the least amount of scope to expand output as monetary policy is eased.

- Data on online vacancies suggest that in London, the South East, and East of England, the labour market is historically not very tight, with employers apparently able to find recruits more easily there than elsewhere, particularly in Northern Ireland, and, to a lesser extent, the North East.

Tags:

Related Posts

Post

GCC: Key themes shaping city economies in the near term

For Gulf cities, the near-term outlook will be tied not only to the global macroeconomic backdrop, but also the progress of the diverse visions and strategies in the region. With the aim to diversify their economies and reduce the dependence on oil, Gulf states continue to invest in the non-oil economy and implement various reforms. That said, oil revenues remain key to funding diversification efforts.

Find Out More

Post

Eurozone: ECB rate cut decisions won’t likely be affected by the Fed

A scenario where neither the Federal Reserve nor the European Central Bank cut rates in 2024 would reduce eurozone GDP by 0.5ppts by 2025. We still think the eurozone economy would grow by 0.5% in 2024, but the projected expansion in 2025 would be 1.4%, lower than 1.8% in our baseline forecast.

Find Out More

Post

Eurozone: New wage growth data suggest no need to delay rate cuts

Our sentiment data suggests that the ECB's worries about sticky inflation driven by strong wage growth are misplaced. The sentiment data-based nowcast, which allows us to track labour market developments in near-real time, suggests that pay growth continued to cool at the start of 2024 and is running below the ECB's projections.

Find Out More