Eurozone: Little sign of harm from the Red Sea disruptions

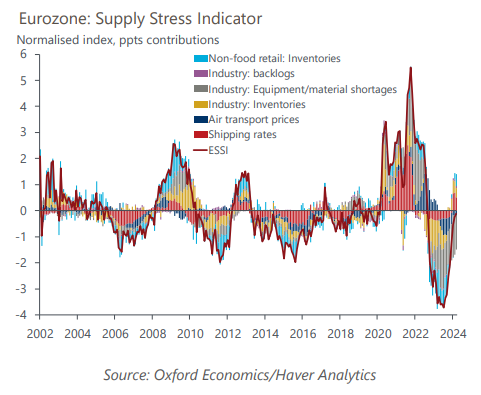

The impact of Red Sea shipping disruption on the eurozone economy continues to be limited, in line with our baseline view. Our new Eurozone Supply Stress Indicator suggests that supply pressures have returned to normal following a period of easing in 2023.

What you will learn:

- In our original assessment, we had assumed shipping rates on the affected routes would rise around 200% and settle at this level for six months. Encouragingly, shipping rates have eased slightly from January peaks. Moreover, early price and firm survey data point to a limited and scattered negative impact so far.

- Given the slow pass-through into domestic prices, we expect the impact of disruptions to peak towards the end of the year. But wider disinflation pressures stemming from falling energy prices and subdued demand mean we expect goods inflation to remain low, and the disruption shouldn’t prevent the ECB from cutting rates.

- Adverse risks haven’t dissipated, though. So far, we haven’t seen any clear signs that missing inputs are causing supply disruption or widespread production shutdowns, but these might show up later. Similarly, while most shipping companies now avoid the Red Sea, an escalation in attacks would have negative knock-on effects on both output and prices in the eurozone.

Tags:

Related Posts

Post

Eurozone: Corporate profit margins have further to fall

Profit margins in the eurozone have largely dropped back towards their long-term pre-pandemic average, after they increased faster than wages during the post-pandemic rebound. But we think margins will narrow further as wages catch up to inflation and productivity remains weak.

Find Out More

Post

Eurozone: ECB rate cut decisions won’t likely be affected by the Fed

A scenario where neither the Federal Reserve nor the European Central Bank cut rates in 2024 would reduce eurozone GDP by 0.5ppts by 2025. We still think the eurozone economy would grow by 0.5% in 2024, but the projected expansion in 2025 would be 1.4%, lower than 1.8% in our baseline forecast.

Find Out More

Post

Eurozone: New wage growth data suggest no need to delay rate cuts

Our sentiment data suggests that the ECB's worries about sticky inflation driven by strong wage growth are misplaced. The sentiment data-based nowcast, which allows us to track labour market developments in near-real time, suggests that pay growth continued to cool at the start of 2024 and is running below the ECB's projections.

Find Out More