Blog | 09 Jun 2023

Industrial spending to drive Australian maintenance activity to new highs

Nicholas Fearnley

Head of Global Construction Forecasting

Australian maintenance expenditure is forecast to average a record $54.5bn over the five years to FY27. We define maintenance as “work undertaken on an asset which improves the standard and/or quality of the asset but does not improve on the original design standard.”

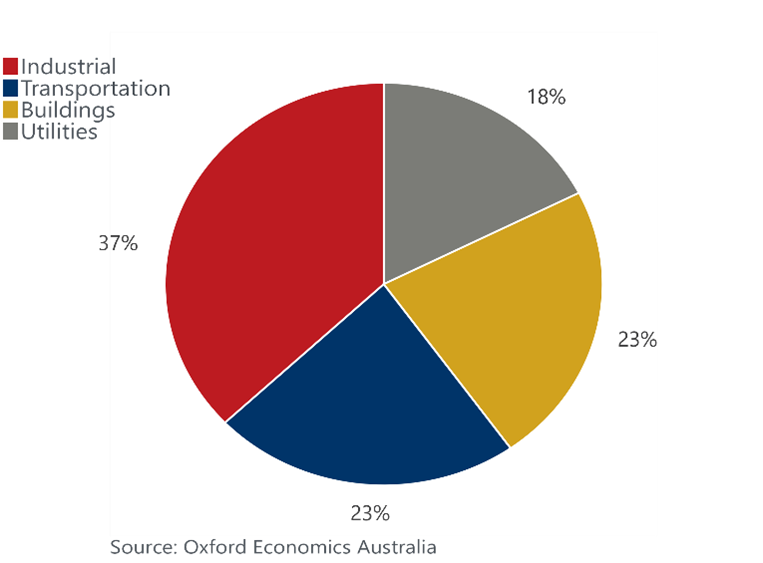

Chart 1: Sectoral composition of maintenance spending for FY23

The industrial sector, which includes mining and manufacturing, is the largest category, accounting for 36% of domestic maintenance spending over FY22. Increasing maintenance requirements of major LNG facilities will ensure that this sector remains the fastest growing over the coming years. Mining maintenance spending more generally will be supported by increasing production following China’s reopening, although there are risks that China’s emission targets could weigh over global demand for metals. Activity for the manufacturing sector is set to grow, albeit at a slower rate, as government programs continue to support the sector.

Transportation maintenance spending is dominated by road maintenance activity. Spending jumped following covid lockdowns as the federal government looked to shovel ready projects to stimulate an infrastructure led recovery. The 2022 east coast floods added to this boom, driving national transportation maintenance work to a record high. Spending is now set to normalize, although there remains significant upside risk to the outlook should flooding occur in population centres, or an economic slowdown drive another wave of government stimulus. Over the medium to longer-term government investment in road and railway infrastructure will increase maintenance requirements.

The outlook for utilities is more subdued. The transition to renewable electricity generation will see coal and gas power stations replaced by wind and solar generators, which have much lower maintenance requirements. Furthermore, the next phase of the NBN expansion will see more of the copper network replaced by fibre, which is also much less costly to maintain. Slow, and at times negative growth in both sectors will lead to a more subdued outlook for total utility maintenance activity.

Growth in non-residential building maintenance spending is expected to remain solid, with work on health and education buildings being the key driver of activity. Defense building maintenance work will also continue to grow as the post-covid backlog continues to be worked through.

Record high levels of maintenance activity are coming at a time when domestic non-oil and gas construction activity is also at record highs. Maintenance requires similar materials and skills to construction activity, and thus further adds to capacity constraints and cost pressures facing the industry. While the federal government is reassessing the delivery of the national infrastructure pipeline, maintenance spending is not as easy to defer. Operators and suppliers can therefore look to the maintenance market to prepare for the future slowdown in construction work.

To learn more about Australian maintenance outlook, download our MAINTENANCE IN AUSTRALIA 2023 EDITION here.

Authors

Nicholas Fearnley

Head of Global Construction Forecasting

+61 2 8458 4262

Nicholas Fearnley

Head of Global Construction Forecasting

Sydney, Australia

Dr Nicholas Fearnley is the Head of Global Construction Forecasting, based in Sydney. Nicholas oversees the teams that produce the various construction, mining, and maintenance studies. He works over the full construction spectrum, and regularly presents and provides commentary for both the construction and mining industries.

Nicholas joined Oxford Economics in 2019 after working at Macromontor, where he was responsible for producing regular Australian building construction forecast reports, and bespoke cost escalation and material demand forecasts.

Prior to joining Macromonitor, Nicholas completed a PhD at the University of Sydney with a thesis titled: “A Critical and Quantitative Analysis of the Relationship between Informal Institutions and Economic Development.” He was awarded the Walter Noel Gillies Prize for best PhD thesis in Economics, and his thesis was accepted without edits.

Nicholas has undergraduate degrees in both Accounting and Applied Finance from Macquarie University, and a first class honours degree in Accounting from the University of Sydney with a thesis titled: “Culture and the Measurement Decision Offered by Investment Property”.

Amy Regan

Senior Economist

Private: Amy Regan

Senior Economist

Sydney, Australia

Senior Economist

Tags:

You may be interested in

Post

How Canada’s wildfires could affect American house prices

The Northern Hemisphere is now heading into the 2024 fire season, having just had its hottest winter on record. If it is anything like last year, we can expect to see further impacts on people, nature, and global markets.

Find Out More

Post

Major China cities face prospect of growth downshift

Over the next five years China and its major cities face the prospect of a significant downshift in economic growth. We forecast GDP to grow on average by 4.1% per year across 15 major cities in the years to 2028, down from 7.3% between 2015-2019.

Find Out More

Post

US metros to see decelerating growth in the medium term

We forecast stable GDP growth across most US metros in 2024, followed by decelerating growth over the subsequent four years. All of the top 50 metros are forecast to see real GDP growth in 2024 as well as continued but slower growth through 2028.

Find Out More