Research Briefing

| May 9, 2023

US: Four tricky paths to avert default

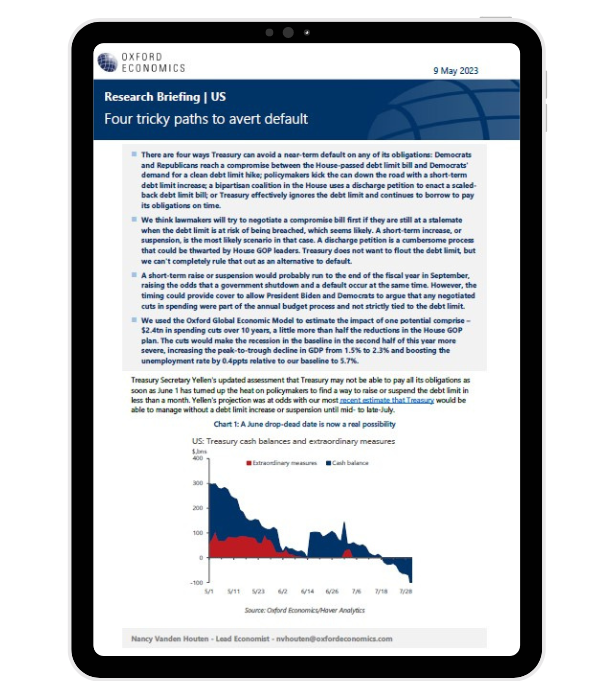

- There are four ways Treasury can avoid a near-term default on any of its obligations: Democrats and Republicans reach a compromise between the House-passed debt limit bill and Democrats’ demand for a clean debt limit hike; policymakers kick the can down the road with a short-term debt limit increase; a bipartisan coalition in the House uses a discharge petition to enact a scaled-back debt limit bill; or Treasury effectively ignores the debt limit and continues to borrow to pay its obligations on time.

- We think lawmakers will try to negotiate a compromise bill first if they are still at a stalemate when the debt limit is at risk of being breached, which seems likely. A short-term increase, or suspension, is the most likely scenario in that case. A discharge petition is a cumbersome process that could be thwarted by House GOP leaders. Treasury does not want to flout the debt limit, but we can’t completely rule that out as an alternative to default.

- A short-term raise or suspension would probably run to the end of the fiscal year in September, raising the odds that a government shutdown and a default occur at the same time. However, the timing could provide cover to allow President Biden and Democrats to argue that any negotiated cuts in spending were part of the annual budget process and not strictly tied to the debt limit.

- We used the Oxford Global Economic Model to estimate the impact of one potential comprise – $2.4tn in spending cuts over 10 years, a little more than half the reductions in the House GOP plan. The cuts would make the recession in the baseline in the second half of this year more severe, increasing the peak-to-trough decline in GDP from 1.5% to 2.3% and boosting the unemployment rate by 0.4ppts relative to our baseline to 5.7%.

Tags:

Related Services

Service

Global Economic Model

Our Global Economic Model provides a rigorous and consistent structure for forecasting and testing scenarios.

Find Out More