Japan: Incoming Governor Ueda is entrusted to tweak the YCC

At Governor Kuroda’s final policy meeting, the Bank of Japan (BoJ) left short-term policy rates at -0.1% and long-term rates at around 0%. Despite mounting pressures on the 10-year JGB, the target range was kept at +/-0.50ppt.

While we did not discount the possibility of a widening of the band to secure a smooth leadership transition, Kuroda appears to have avoided a sharp rise in JGB yields before the end of the fiscal year. In particular, further losses in the domestic bond portfolio threaten the profitability of the already vulnerable regional banks.

What you will learn:

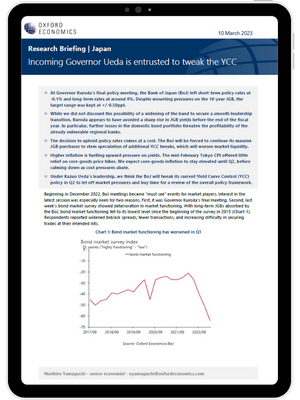

- The decision to uphold policy rates comes at a cost. The BoJ will be forced to continue its massive JGB purchases to stem speculation of additional YCC tweaks, which will worsen market liquidity.

- Higher inflation is fuelling upward pressure on yields. The mid-February Tokyo CPI offered little relief on core-goods price hikes. We expect core-goods inflation to stay elevated until Q2, before calming down as cost pressures abate.

- Under Kazuo Ueda’s leadership, we think the BoJ will tweak its current Yield Curve Control (YCC) policy in Q2 to let off market pressures and buy time for a review of the overall policy framework.

Tags:

Related Resouces

Post

Surprisingly strong wage data ends NIRP and YCC in Japan

The Bank of Japan (BoJ) decided to end its negative interest rates policy and set the target band for the overnight market rate at 0%-0.1% at Tuesday's meeting, earlier than our call for April.

Find Out More

Post

Will Japan policy adjustments accompany the end of NIRP?

Markets appear to be increasingly converging with our forecast that the Bank of Japan will abolish its negative interest rate policy at the April meeting, but views diverge on whether any other policy adjustments will accompany the end of NIRP.

Find Out More

Post

No change in policy as BoJ waits for wage data

The Bank of Japan left both short-term and long-term policy rates unchanged at Tuesday's meeting. Amid a decline in global yields, pressures on the Yield Curve Control (YCC) policy framework from bond and foreign exchange rate markets have eased.

Find Out More