Another UK rate hike is coming, but the peak may be in sight

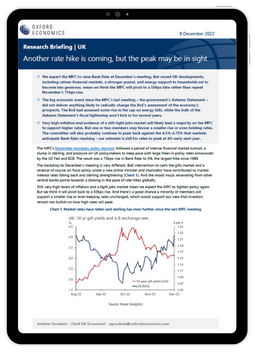

We expect the MPC to raise Bank Rate at December’s meeting. But recent UK developments, including calmer financial markets, a stronger pound, and energy support to households set to become less generous, mean we think the MPC will pivot to a 50bps hike rather than repeat November’s 75bps rise.

What you will learn:

- The big economic event since the MPC’s last meeting – the government’s Autumn Statement – did not deliver anything likely to radically change the BoE’s assessment of the economy’s prospects. The BoE had assumed some rise in the cap on energy bills, while the bulk of the Autumn Statement’s fiscal tightening won’t kick in for several years.

- Very high inflation and evidence of a still-tight jobs market will likely lead a majority on the MPC to support higher rates. But one or two members may favour a smaller rise or even holding rates. The committee will also probably continue to push back against the 4.5%-4.75% that markets anticipate Bank Rate reaching – our estimate is still for rates to peak at 4% early next year.

Tags:

Related Services

Service

UK Region and LAD Forecasts

Regularly updated data and forecasts for UK regions and local authority districts.

Find Out More

Service

European Cities and Regions Service

Regularly updated data and forecasts for 2,000 locations across Europe.

Find Out More

Service

European Macro Service

A complete service to help executives track, analyse and react to macro events and future trends for the European region.

Find Out More