Canadian economy heading for hard landing

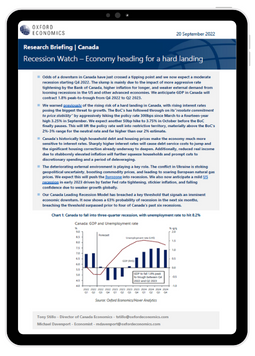

Odds of a downturn in Canada have just crossed a tipping point and we now expect a moderate recession starting Q4 2022. The slump is mainly due to the impact of more aggressive rate tightening by the Bank of Canada, higher inflation for longer, and weaker external demand from looming recessions in the US and other advanced economies. We anticipate GDP in Canada will contract 1.8% peak-to-trough from Q4 2022 to Q2 2023.

What you will learn:

- We warned previously of the rising risk of a hard landing in Canada, with rising interest rates posing the biggest threat to growth. The BoC’s has followed through on its “resolute commitment to price stability” by aggressively hiking the policy rate 300bps since March to a fourteen-year high 3.25% in September.

- Canada’s historically high household debt and housing prices make the economy much more sensitive to interest rates. Sharply higher interest rates will cause debt service costs to jump and the significant housing correction already underway to deepen.

- The deteriorating external environment is playing a key role. The conflict in Ukraine is stoking geopolitical uncertainty, boosting commodity prices, and leading to soaring European natural gas prices. We expect this will push the Eurozone into recession.

Tags:

Related Services

Service

Canadian Province and Metro Service

Data and forecasts for Canadian provinces and metropolitan areas.

Find Out More

Service

Canada Macro Service

Comprehensive coverage of the Canadian economy, providing clients with all of the information they need to assess the impact of developments in the economy on their business.

Find Out More

Service

Canada Provincial Territorial Model

A rigorous and comprehensive framework to develop forecasts, scenarios and impact analysis at the national, provincial and territorial levels.

Find Out More