Blog | 22 Jun 2022

Not all visitors are created equal: Which tourists give destinations the most bang for their buck?

Michael Shoory

Head of APAC Tourism Analysis

As international tourism bounces back from the pandemic, destination stakeholders are understandably eager to maximise the impact of that recovery in terms of jobs, spending and profits. The composition of visitors is an important strategic consideration for destination marketing organisations, given that travel from different distances and source markets is expected to recover at a varying pace. This must be balanced against the value these different types of visitors bring to destination economies—that is, how much those tourists typically spend in the local economy, and the associated flow-on impact to jobs, wages and earnings.

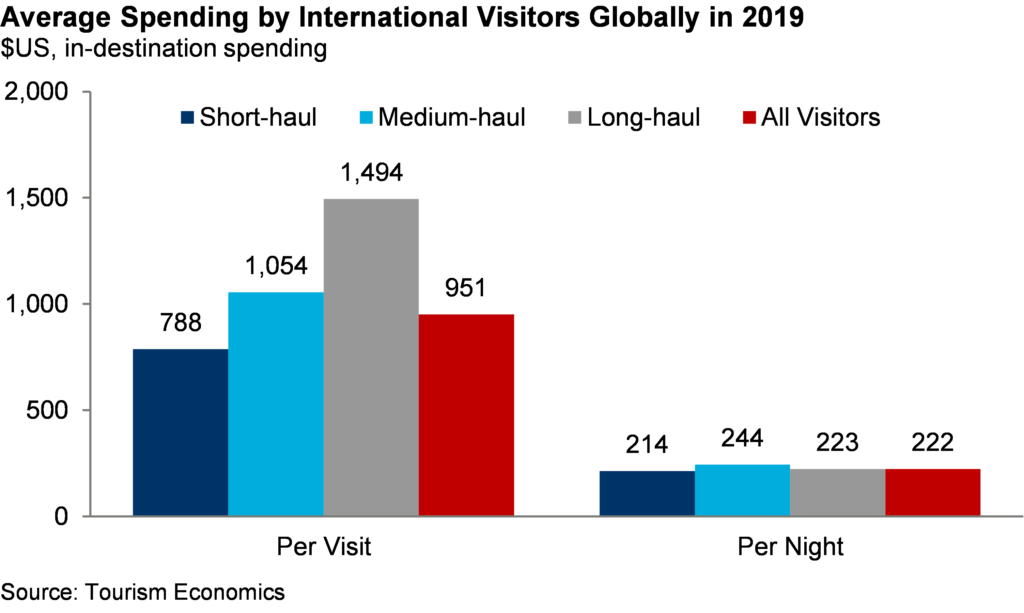

On average, long-haul visitors provide the greatest value for destinations globally, spending almost $1,500 per trip in 2019. This is significantly higher than the average spend per-visit of tourists sourced from medium-haul (a little over $1,000) and short-haul (almost $800) markets. The bulk of this variation is driven by the higher average length of stay (ALOS) of long-haul visitors—6.7 nights per trip in 2019, compared with around 4 nights for short- and medium-haul tourists—reflecting the longer visit needed to justify the higher expense and duration of transportation for such a trip.

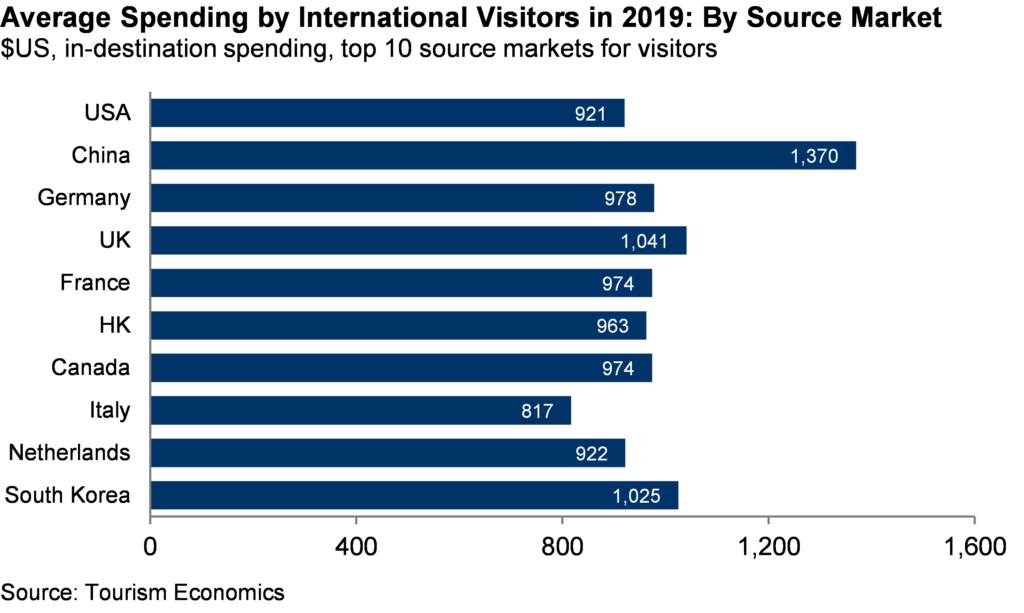

There is also significant variation across individual markets. Among the ten largest global source markets for international visitors in 2019, Chinese visitors provided the greatest value for destinations, spending an average of US$1,370 each visit and $479 per night. By comparison, visitors from the US spent an average of $921 per trip and $182 per night.

However, it is not as simple as targeting the highest spending visitors to maximise recovery. Longer-haul tourism, which on average provides greater value for destinations, is expected to recover more slowly than short- and medium-haul. While among the highest value visitors, the recovery of Chinese outbound travel is expected to lag that of other major markets in the near-term, including the comparatively lower-spending US market. There will also be differences in the value of different visitors across destinations, reflecting the type of trip (business, leisure, visiting friends/relatives) and length of travel. For example, tourists from the US spend an average of around $120 per night and $520 per trip elsewhere in North America. However, in Asia-Pacific destinations they spend $215 per night and almost $1,900 per trip.

Other factors will also determine which source markets should be prioritised. Sustainability implications are becoming a greater consideration, and the higher carbon intensity of air travel compared to that of road and rail means that higher-value long-haul visitors are associated with greater environmental costs. In addition, over-reliance on a small number of high-value markets can be risky if travel from those markets is disrupted, as has been the case with China’s “zero covid” approach to the pandemic. Nevertheless, those markets that provide a greater bang for the marketing buck will be one crucial factor in supporting the tourism recovery and restoring the economic benefits of the sector.

Tags:

You may be interested in

Post

Promising trends signal optimism for the hotel sector

The global travel recovery took great strides in 2023, with some destinations already reporting a full recovery back to pre-pandemic levels. Trends continue to suggest further growth in tourism activity going into this year, signalling optimism for the hospitality sector going forward. But risks stemming from inflation, geopolitical tensions and climate change will persist.

Find Out More

Post

High satisfaction generates loyalty in the cruise industry, but experiences vary across segments and destinations

Tourism Economics’ latest cruise industry research briefing based on research among active cruisers identified strong underlying satisfaction with cruise experiences globally as nearly 90% rated their last cruise as good or very good.

Find Out More

Post

Global Cruise Trends Report: March 2024

This report delves into research conducted in Q4 2023 across five key cruise markets, all indicating strong cruise demand. Our comprehensive market intelligence aims to equip the travel industry with insights into the significant growth potential in the cruise industry.

Find Out More