News | 26 May 2022

Australia’s CAPEX falters in Q1, with cost inflation to test activity

Thomas Rudgley

Economist, Macro Consulting

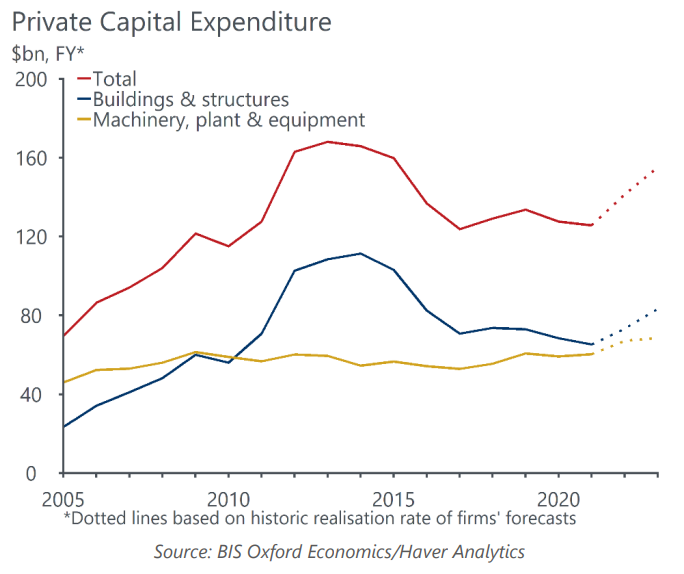

- Private new capital expenditure fell 0.3% q/q in Q1 2022, led lower by a fall in buildings and structures investment. The weak result is in part due to the impact of Omicron on labour availability, and the postponement of construction activity in flood affected areas. Machinery & equipment volumes rose in the quarter.

- Expectations for FY23 remain strong across mining and non-mining sectors. Today’s data provide another bullish read for buildings and structures spending, while machinery & equipment spending is also expected to lift – a sharp departure from the fall predicted in the February data. However, the exacerbation of supply side issues stemming from the war in Ukraine and lockdowns in China means a good deal of the increase in expectations is due to cost inflation, which will dampen the impetus to growth from investment activity.

The March quarter was challenging for private business investment. Buildings & structures spending fell 1.7% q/q, partly offset by a 1.2% q/q rise in machinery & equipment expenditure. The rapid spread of Omicron cases left many firms short-handed as staff were forced to isolate or take sick leave. Flooding in New South Wales and Queensland will have also weighed on construction activity. Machinery & equipment spending is less affected by these disruptions as a high share of equipment is imported.

Adjusting for firms’ historic realisation ratios, firms are providing a strong read on expenditure over FY23, with growth of 9.8% now expected. Buildings and structures investment is expected to drive growth, but machinery & equipment spending is now also expected to increase – a turnaround from the last read three months ago. However, the strength in expenditure plans will largely be due to higher inflation expectations, with the war in Ukraine lifting oil prices, and extended lockdowns in China worsening supply chain woes. We expect the response of mining investment to higher commodity prices will be limited.

Meet the team

Sean Langcake

Head of Macroeconomic Forecasting, OE Australia

+61 2 8458 4236

Sean Langcake

Head of Macroeconomic Forecasting, OE Australia

Sydney, Australia

Sean Langcake is Head of Macroeconomic Forecasting at Oxford Economics Australia where he is responsible for macro forecasting and analytical content. Sean is a regular contributor in the national media on Australian and global economic trends and policy issues.

Prior to joining Oxford Economics, Sean worked in a wide variety of roles at the Reserve Bank of Australia, largely focussing on forecasting and macroeconomic modelling. Sean holds a Masters Degree in Economics from the University of New South Wales, as well as a first class Honours degree in Economics and a Bachelor of International Studies from the University of Adelaide.

Thomas Rudgley

Economist, Macro Consulting

+61 (0) 2 8458 4223

Thomas Rudgley

Economist, Macro Consulting

New York, United States

Thomas is part of Oxford Economics’ Macroeconomics Consulting team based in New York. He produces scenario analysis, forecasts, and data visualisations across a range of industries to help clients navigate the tumultuous economic environment.

Tags:

You may be interested in

Service

Australia Macro Service

In-depth insights and analysis of key domestic and global trends, enabling clients to make better strategic decisions, manage risks and take advantage of newly-developing opportunities in a fast-changing economic environment.

Find Out More

Post

Australian revenue upside allows purse strings and a smaller deficit

The strong performance of the Australian economy over the past six months has led to a sizeable revision of Treasury's projections for the budget deficit. Stronger-than-expected revenue growth means a deficit of 3.5% of GDP is now expected in FY22, down from 4.5% of GDP in the last MYEFO from October 2021. The ongoing strength in the labour market and higher commodity prices are the main sources of the revision to revenue projections.

Find Out More

Post

Australia’s cooling property market no immediate threat to new housing

Residential real estate markets globally performed strongly over 2020 and 2021 and Australia was no exception. Low borrowing costs, grant incentives, pandemic driven housing preference shifts, elevated savings and amassed household wealth underpinned the strong property price growth recorded over the last two years

Find Out More