GCC: Key themes shaping city economies in the near term

For Gulf cities, the near-term outlook will be tied not only to the global macroeconomic backdrop, but also the progress of the diverse visions and strategies in the region. With the aim to diversify their economies and reduce the dependence on oil, Gulf states continue to invest in the non-oil economy and implement various reforms. That said, oil revenues remain key to funding diversification efforts.

What you will learn:

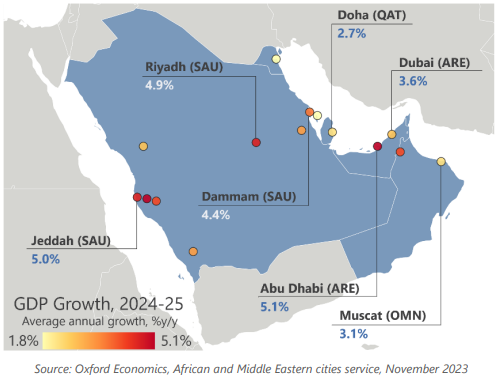

- Two themes to watch out for over the next two years are (1) the increasingly competitive business environments across the main gulf states and (2) the recovery and growth of the tourism sector. Both factors will boost economic growth, employment, and consumer spending across cities.

- Momentum in the non-oil sector remains strong in Saudi Arabia, supported by substantial investment as progress continues towards the goals of Vision 2030. Growth in non-oil GDP is supporting employment across the Kingdom’s main cities, with growth at 4.2% in Riyadh, 4.5% in Jeddah, 4.6% in Mecca and 4.5% in Medina in 2024. This growth is boosted by foreign companies setting up regional headquarters, particularly in Riyadh.

- The UAE is an open economy and faces headwinds from other parts of the global economy. But domestic activity is underpinning its resilience. Inflation has stabilised, the fiscal position has improved (especially for Dubai), and an improving outlook for the labour market will support growth. We expect employment to grow by 2.4% in 2024 in Dubai. Abu Dhabi’s diversification effort is progressing with the non-mining industrial sector playing a big role in the advancement. We are of the view that the UAE officially joining BRICS+ will push for more activity and investment in the industrial and logistics sector through expanded market access and less trade barriers, which should benefit Abu Dhabi further.

- One of the most closely watched countries in the region is Saudi Arabia. A key feature of the Kingdom’s efforts to diversify away from oil is the development of giga projects (defined as projects above $10 billion), an initiative headed up by the Public Investment Fund (PIF), the official sovereign wealth fund of Saudi Arabia. Since 2016, the Kingdom has initiated projects valued at over $1.25 trillion, including NEOM, Diriyah, and the Riyadh Metro, among others. The scale of these projects is unique, and they represent a substantial step towards achieving the Kingdom’s ambitious goals.

Tags:

Related Posts

Post

Iran-Israel tensions should dissipate after latest flare up

The military escalation between Iran and Israel has ratcheted up fears of an expanded Middle East conflict. The threat of counter strikes by Israel is clearly heightened, but we think both sides will ultimately seek to avoid a costly all-out war.

Find Out More

Post

US REITs set to outperform the eurozone and UK in H1

We think that global real estate investment trust (REIT) prices will continue to grow in H1 on the expectation that a soft landing will sustain income growth and underlying asset values will find a floor.

Find Out More

Post

Commodity markets turned slightly more bullish last week

Spot crude oil prices continue to be held back by demand woes, despite recent moves to tighten the market by Saudi Arabia. However, in a sign that sentiment may be starting to turn, net long positions rose last week, suggesting markets are starting to become more bullish.

Find Out More